Top Budget Hacks to Stay Ahead 2025

Managing your finances doesn’t have to be stressful or time-consuming. With these clever budget hacks, you can maximize your savings and take control of your money effortlessly.

Use budgeting apps to track your spending in real-time, take advantage of cashback offers, and embrace meal prepping to reduce food costs.

Whether you’re saving for a big purchase or just want to build a stronger financial foundation, these hacks are your go-to guide for financial success. Start today and stay ahead of the curve!

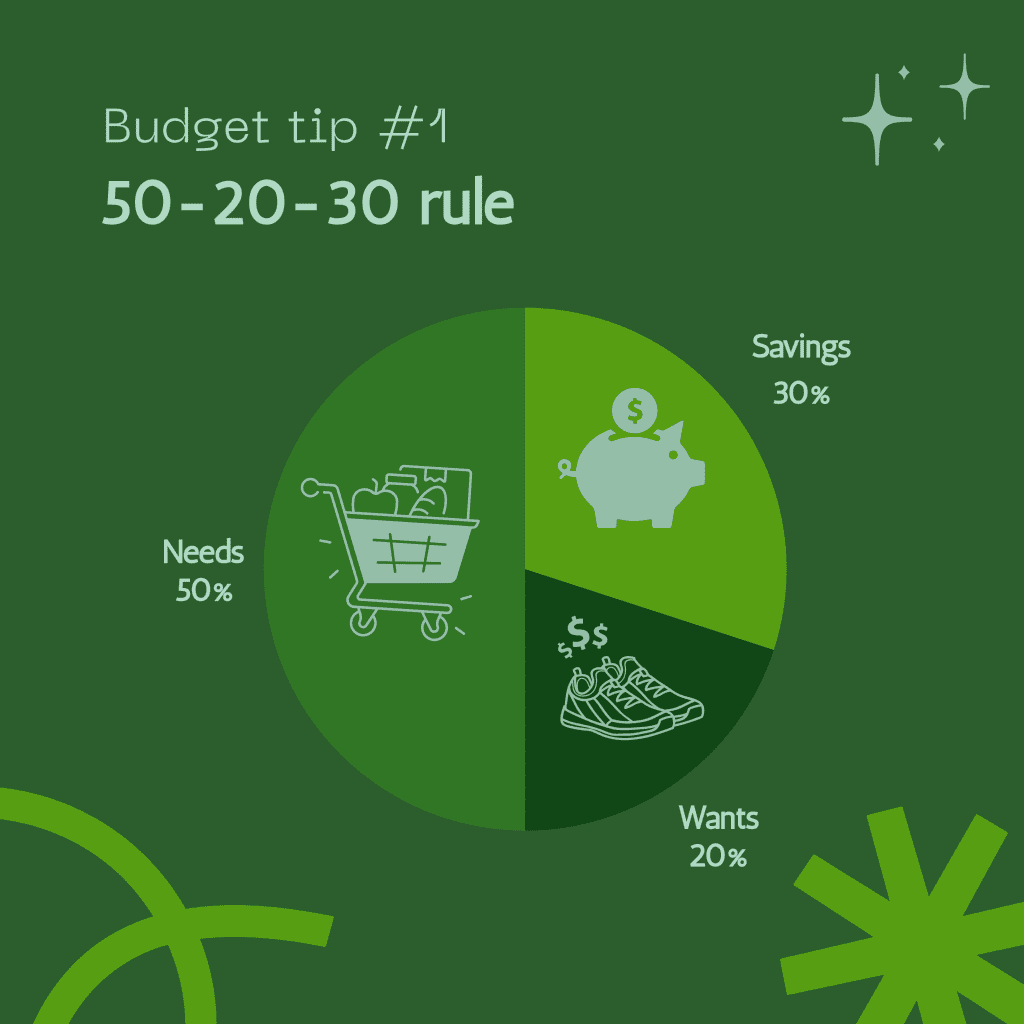

1. Use the 50/30/20 Rule

Divide your income into three categories, most budgeting apps will automatically help you track your spending by giving you a breakdown on a pie graph to make it easier.

Have a look at the top 3 budget apps down below. These apps make life so much easier to manage one of the top budget hacks.

- 50% Needs: Rent, utilities, groceries.

- 30% Wants: Entertainment, dining out.

- 20% Savings: Emergency fund, debt repayment, investments.

This simple framework ensures you’re prioritizing essentials while still enjoying life.

2. Automate Savings

Life gets busy and automation is definitely the key to using top budget hacks for 2025. Organise and spend some time going over our expenses.

Personally. I also use a calendar reminder on what will be debited on which days to avoid overdrawn accounts. I think this

- Set up automatic transfers to a savings account every payday.

- Use round-up savings apps that round up purchases and stash the difference into savings.

Small, consistent contributions add up over time without much effort. - Calendar reminders of direct debits

3. Embrace Meal Prepping

Lunches don’t need to be boring there are tons of inspiration on snacks and meal prepping. These days we spend a lot of our time commuting, after school activities and some of us work from home so we can still prepare our meals in advance even if we are at home.

Time to mix it up, get creative.

- Plan and cook meals in bulk for the week to avoid impulse spending on takeout.

- Use a shopping list and stick to it to reduce grocery store splurges.

- Incorporate seasonal and discounted items into your menu for added savings.

4. Review Subscriptions

Every year just like writing down our yearly goals, it is a good time to look at all our subscriptions, finances, budget, joint savings for whatever we are planning. Car, home, business loans too.

- Audit your subscriptions for streaming, gym memberships, or apps you rarely use.

- Cancel or downgrade unused services and focus on free or affordable alternatives.

5. Shop Smarter

When we are shopping think about is it worthwhile having our shopping home delivered so that we are not overspending, or maybe you like to buy around the clearances and discounts and make use of the savings and prepare meals around that.

What is the best time to shop and what days as different shops mark down there foods and fresh produce at different time and to be smart whether you can use it immediately or will it freeze. Plan meals with the purchases adjust your meal prepping.

Is it worth buying in bulk if you are trying to save.

- Use cashback apps and loyalty programs to earn rewards on everyday purchases.

- Buy generic brands, which often offer the same quality as name brands at a lower cost.

- Wait 24 hours before making a non-essential purchase to avoid impulsive buys.

6. Master Energy Efficiency

There are a lot of top budget hacks out there and have to say this is one that can be overlooked particularly if renting. Also think about the washing machine, dryer, TV and so forth can be turned off after use and see if it helps to save on electiricty costs.

Think about installing solar.

- Switch to energy-efficient light bulbs and appliances.

- Unplug devices when not in use to avoid phantom electricity costs.

- Use a programmable thermostat to control heating and cooling expenses.

7. Declutter and Sell

Decluttering is one of the best and rewarding things anyone can do as it creates good energy and helps us to function emotionally and mentall without the weight of stuff around us that is no longer needed. Give someone else the opportunity to purchase at a cheaper price than new.

Before you throw it out give it a chance on the platforms and if it doesn’t sell donate to charity and make a pact to still get rid of the item.

- Regularly declutter your home and sell unwanted items on platforms like Facebook Marketplace or eBay.

- The extra cash can go directly toward debt repayment or savings.

8. Refinance Loans

Refinancing is definitely something we need to consider, especially credit card debts, zip pays, unsecured personal loans, car loans and home loans.

Click here to have a look at our refinancing service page and or the debt consolidation service page

for home loans you can click here…

There can be significant savings and I would highly suggest if if is not worth refinancing, look at rounding off the amount and adding that to the payments and see how you are traveling on the debts at the end of the year.

- Shop around for better interest rates on home loans, personal loans, or car loans.

- Consolidate debt into one manageable loan with a lower interest rate.

9. Use Budgeting Tools

- Apps like YNAB, Mint, or PocketGuard help track spending and create budgets.

- Google Sheets and pre-made templates are free options for manual budgeting.

Goodbudget App Here is the link to there website to review -https://goodbudget.com/

Mint App is one of intuit products which they have quickbooks so you maybe familiar with the company https://mint.intuit.com/

Google sheets have many templates that you can purchase and or if you are savvy and want to design and customise your own, you could have a lot of fun. https://docs.google.com/spreadsheets/d/17bJyLZ4lTA4T5Zc8V3ez0Tix2hwaA7EoOR1V9Gow6Js/htmlview

10. DIY Whenever Possible

Youtube is the best way to learn a new hobby, skill and or trick you would be surprised at how simple something maybe to fix yourself and or ask a friend for a favour to help you out.

Make your own gifts, there is nothing more special than a homemade gift as it is so thoughtful.

- Opt for DIY home repairs, car maintenance, or gifts to save significantly.

- Use free online tutorials to learn new skills or tackle simple projects.

11. Plan Staycations

This is one of the top budget hacks that came into play when we had COVID lock downs. Entertain at home, there are some amazing night in themes you can do and invite the neighbours.

Exploring local attractions and historical places and getting to know the neighbourhood have your own find it places in the local community.

- Explore local attractions, parks, or beaches instead of expensive vacations.

- Look for free community events for family-friendly entertainment.

12. Track Progress

Just like a diet, track you spending and savings. Have a good look at your spending habits and make small changes without feeling deprived.

- Monitor spending habits weekly to identify patterns and areas for improvement.

- Celebrate small milestones, like paying off a debt or reaching a savings goal, to stay motivated.

PIN THIS PINTEREST PIN FOR MORE SAVING HACKS!