The Real Costs of Refinancing Explained:

Understanding the Financial Implications

Refinancing your mortgage can be a powerful financial tool, potentially lowering your interest rate, reducing monthly payments, or tapping into home equity.

However, it’s essential to understand the real costs of refinancing and what is involved to make an informed decision. We’ll delve into the various costs of refinancing, provide examples, and discuss how to find the best refinance home loan with affordable mortgage rates.

What is Refinancing Explained?

Refinancing involves taking out a new mortgage to replace an existing one, typically with better terms or conditions. Homeowners refinance for several reasons:

- Lowering Interest Rates: To reduce monthly payments and overall interest expenses.

Changing Loan Terms: To switch from a 30-year to a 15-year mortgage, or vice versa.

Tapping into Home Equity: To access cash for home improvements, debt consolidation, or other expenses.

- Switching Loan Types: To move from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage for more stability.

While refinancing can offer significant benefits, it’s crucial to weigh these against the costs to determine if it’s the right financial move.

The Costs of Refinancing

1. Application Fees

Application fees are typically charged by lenders to cover the cost of processing your loan application. These fees can vary widely but generally range from $75 to $500.

Example: Suppose you’re refinancing a $300,000 mortgage. If the lender charges a $300 application fee, that’s $300 added to the total cost of refinancing.

2. Origination Fees

Origination fees are charged by lenders for evaluating, preparing, and submitting your loan. These fees usually amount to about 0.5% to 1% of the loan amount.

Example: For a $300,000 mortgage, an origination fee of 1% would be $3,000. This fee covers the cost of underwriting and other administrative tasks.

3. Appraisal Fees

Most lenders require a home appraisal to determine the current market value of your property. Appraisal fees generally range from $300 to $700.

Example: If your lender requires an appraisal costing $500, this amount is added to your refinancing expenses. If the appraisal reveals a lower value than expected, it could impact your ability to refinance on favorable terms.

4. Inspection Fees

Depending on your lender and the property’s condition, you may need to pay for a home inspection, which typically costs between $200 and $400.

Example: If a home inspection is required and costs $300, this is an additional expense on top of other refinancing costs.

5. Title Insurance and Title Search Fees

Mortgage (title) insurance protects the lender (and optionally, you) against any legal issues with the property’s title.

Title search fees and insurance premiums can vary but typically cost between $400 and $1,000.

Example: If the title insurance and search cost $600, this amount is added to your overall refinancing costs.

6. Prepayment Penalties

Some mortgages include prepayment penalties for paying off the loan early, including through refinancing. These penalties can vary widely depending on your loan agreement.

Example: If your current mortgage includes a prepayment penalty of 2% on a $300,000 balance, you would owe $6,000 if you refinance before the penalty period ends.

7. Closing Costs

Closing costs include various fees associated with finalizing your refinance, such as attorney fees, document preparation fees, and recording fees. These costs typically range from 2% to 5% of the loan amount.

Example: For a $300,000 mortgage, closing costs of 3% would be $9,000. This amount covers fees such as document preparation and legal services.

Calculating the Real Costs of Refinancing

To understand whether refinancing is financially beneficial, you need to calculate the total costs and compare them to your potential savings. Here’s a step-by-step method to evaluate the costs:

Adding Up All Costs:

An Example

Sum up all the costs associated with refinancing, including application fees, origination fees, appraisal fees, inspection fees, title insurance, prepayment penalties, and closing costs.

Example Calculation:

Application Fee: $300

Origination Fee: $3,000

Appraisal Fee: $500

Inspection Fee: $300

Title Insurance and Search: $600

Prepayment Penalty: $6,000

Closing Costs: $9,000

Total Costs: $19,700

Determine Your Savings:

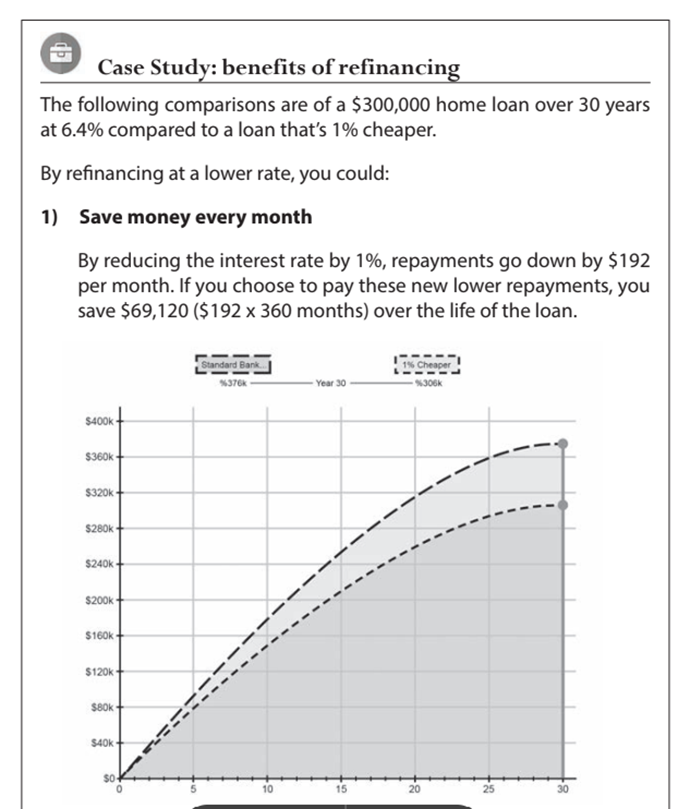

- Calculate the potential savings from refinancing. This typically includes a lower interest rate and reduced monthly payments.

Example Calculation:

Calculate the Break-Even Point:

- Divide the total refinancing costs by your annual savings to determine how long it will take to recoup the costs through savings.

Example Calculation:

In this example, it would take approximately 9.3 years to recover the refinancing costs through the savings on your monthly payments.

If you plan to stay in your home for longer than this period, refinancing may be a worthwhile investment. If not, the costs may outweigh the benefits.

Finding the Best Refinance Home Loan with Affordable Mortgage Rates

To maximize the benefits of refinancing, it’s crucial to find the best refinance home loan with affordable mortgage rates. Here are some tips for finding the best rates:

1. Shop Around

Different lenders offer varying rates and terms, so it’s essential to compare multiple offers. Obtain quotes from several lenders and mortgage brokers to find the best deal.

Example: If Lender A offers a 3.5% rate while Lender B offers a 3.25% rate, choosing Lender B could result in lower monthly payments and overall interest costs.

2. Check Your Credit Score

Your credit score plays a significant role in determining your mortgage rate. A higher credit score typically qualifies you for better rates. Review your credit report and address any issues before applying for a refinance.

Example: Improving your credit score from 680 to 720 could qualify you for a lower interest rate, potentially saving you thousands over the life of the loan.

If you would like to obtain a free Credit Report click Here

3. Consider the Loan Term

Shorter loan terms often come with lower interest rates, but higher monthly payments. Conversely, longer terms may have higher rates but lower monthly payments. Choose a loan term that aligns with your financial goals.

Example: A 15-year mortgage at 3% may have a lower rate compared to a 30-year mortgage at 3.5%. However, the monthly payment for the 15-year term will be higher.

4. Evaluate Fees and Closing Costs

Compare not just the interest rates but also the associated fees and closing costs. Some lenders may offer lower rates but higher fees, which could offset the potential savings.

Example: Lender A offers a 3.5% rate with $2,000 in fees, while Lender B offers a 3.75% rate with $1,000 in fees. Depending on your situation, Lender A might offer a better overall deal.

5. Negotiate Terms

Don’t hesitate to negotiate with lenders to secure the best possible terms. Ask about potential discounts, fee waivers, or rate reductions.

Example: If a lender is willing to waive the application fee or reduce the origination fee, this can significantly lower your overall refinancing costs.

Check out here which lenders offer no application fees

In a Nutshell – Wrapping it up…

Refinancing your mortgage can offer substantial benefits, visit us today to see whether it is viable to do so, it doesn’t cost you anything to ask.

Here are some things to consider, such as lower monthly payments, reduced interest rates, or access to home equity. However, it’s essential to understand the real costs involved to ensure that the benefits outweigh the expenses.

By considering all associated costs, calculating potential savings, and comparing offers from multiple lenders, you can make an informed decision and find the best refinance home loan with affordable mortgage rates.

Whether you’re aiming to lower your monthly payments, shorten your loan term, or tap into your home’s equity. Careful planning and thorough research will help you achieve your financial goals while managing the costs of refinancing effectively.