The Economic Engine and the Financing Challenge

1.1 The Critical Role of Australian SMEs: Quantifying the Economic Backbone

Small and medium enterprises (SMEs) are undeniably the foundation of Australia’s economy and community infrastructure. Defined broadly as businesses with fewer than 200 employees, the sector comprises a staggering 98% of the nation’s total enterprises. Their economic contribution is quantified not only by volume but by output: outside of the finance, insurance, and public sectors, SMEs generate approximately $700 billion in value-added activity, representing 54% of all business activity in those industries.

The financial health of this segment directly dictates national stability, particularly regarding employment. SMEs account for two-thirds of all private sector jobs in Australia. Lending to this demographic is therefore critical to maintaining employment levels, stimulating localized economic growth, and preserving the social fabric of both metropolitan and regional communities. When a business owner seeks a loan, the capital secured is not merely a transaction; it is a vital input that fuels stability, growth, and job creation across the country.

1.2 Navigating the Headwinds: Profitability, Cost Pressure, and Market Contraction

The economic climate for Australian small businesses has grown increasingly challenging in recent years. Analysis from the Reserve Bank of Australia (RBA) indicates that growth in demand has slowed considerably while input costs remain elevated. For businesses reliant on discretionary consumer spending, such as hospitality and retail, this pressure on profitability is particularly acute. Furthermore, higher interest rates have flowed through to indebted businesses’ operating expenses. Since April 2022, rates on new SME loans have increased by around 365 basis points.

Survey measures of operating conditions for small businesses remain below historical averages and are consistently weaker than those reported by large businesses. This environment places tremendous importance on securing financing at the most competitive rates available, as every basis point saved contributes directly to tighter profit margins.

Despite these significant headwinds, the SME sector demonstrates considerable resilience. Although high interest expenses are squeezing margins , many businesses accumulated sizable cash buffers during and immediately following the pandemic, contributing to their capacity to absorb recent shocks. This persistence suggests that while insolvency rates are increasing, they remain, on a cumulative basis, below the pre-pandemic trend. This indicates that many SME owners currently seeking external capital are not in distress, but are resilient, well-capitalised enterprises looking for strategic funding to invest in efficiency, maintain competitive advantage, or execute targeted growth plans in a highly constrained market. The decision for these proprietors often involves pivoting resources towards automation and internal improvements rather than large capital expenditure bets, making the structure and cost of the loan even more crucial.

1.3 The High-Risk Equation: Collateralisation and Rate Differentials

A defining characteristic of the Australian SME lending landscape is the persistent structural disadvantage small businesses face regarding the cost of capital. Banks assess loans to small firms as inherently riskier propositions due to higher failure rates, particularly among younger firms. This assessment is quantified by lenders: RBA analysis indicates that loans to SMEs are generally expected to fall into arrears at approximately

twice the rate of loans extended to large firms. Historical data reflects this disparity, showing that 90-day arrears for bank lending to unincorporated businesses (2.6%) were substantially higher than arrears for standard home loans (0.7%).

This structural risk translates directly into higher costs. Current RBA data demonstrates a clear risk premium applied across the business size spectrum, where small businesses pay significantly more for credit than their larger counterparts.

Table 1: Australian Business Lending Rates by Enterprise Size (New Loans, % p.a.)

| Business Size (RBA Definition) | Average New Loan Rate (% p.a.) | Analysis of Risk Margin |

| Large Business | 4.89% | Lowest baseline commercial risk |

| Medium Business | 5.57% | Moderate risk premium applied |

| Small Business | 6.60% | Highest risk premium applied by lenders |

| Source: RBA Statistical Table F7 (Rates as of July 2025 or most recent comparable data) |

The 171 basis point spread between large business and small business lending highlights the challenge faced by proprietors seeking funding. Furthermore, due to this elevated risk profile, most SME lending in Australia is secured by some form of collateral, which allows the lender to recoup losses in the event of default. Unlike loans to large firms, which are often unsecured, SME loans almost always require collateralisation, frequently involving the business owner’s personal assets or residential property.

While the Australian Prudential Regulation Authority (APRA) adjusted capital requirements for banks’ SME loans in January 2023, intending to make this segment more appealing to major lenders , the data confirms that the pricing differential remains substantial. The inherent complexity of the SME borrower—including less standardized financial data and the higher intrinsic failure rate—overrides regulatory concessions. Therefore, mitigating or justifying this risk to lenders requires sophisticated financial presentation and deep market knowledge, which goes beyond standard banking relationships.

The Strategic Power of External Finance: Driving Growth and Innovation

2.1 Why Local Businesses Need Debt Capital: Beyond Just Cash Flow

Debt capital for Australian SMEs serves purposes far beyond merely balancing the books or covering a short-term cash shortfall. Strategic borrowing is crucial for growth, market expansion, staff employment, and the essential replacement of plant and equipment. This is particularly relevant as Australian SMEs overwhelmingly prefer debt finance over equity, being three times more likely to apply for debt.

However, the nature of growth capital itself presents a challenge, especially for innovative firms. Although approximately half of surveyed Australian SMEs are innovating at any one time, a lack of financing is often cited as a key barrier to realizing these innovations.

A significant portion of modern business investment, particularly in technology and research, involves intangible assets (e.g., intellectual property, software development, branding). These assets have a long and often uncertain payoff horizon. Traditional secured lenders struggle to value these assets, as they lack the stable market value and ease of liquidation required for high-quality collateral. This valuation difficulty leads to credit rationing, meaning innovative firms with high growth potential may be denied funding by conventional sources.

The implication of this financing gap is profound: the capital structure must align with the type of growth asset being funded. Securing finance for a tangible asset like a new vehicle or machinery falls under traditional asset finance. Securing finance for digital transformation or market entry (intangible assets) requires accessing specialized “growth credit” or non-traditional lenders who are increasingly using transaction data to assess unsecured risk. An expert intermediary must understand this fundamental difference to match the proprietor’s strategic vision to the correct financial product.

2.2 Sector Deep Dive: Case Studies in Transformation

The practical application of business lending reveals how targeted finance can overcome structural limitations and accelerate specific growth objectives across core Australian sectors, such as hospitality and retail.

Case Study A: The Café/Restaurant Acquisition (Leveraging Equity)

The hospitality sector often involves high capital expenditure, making property or asset acquisition a complex financing challenge. In one documented scenario, a client sought $400,000 to purchase a Sydney CBD café. Despite having significant net assets (over $1.4 million), their available savings were insufficient, and their primary wealth was tied up in two cross-collateralised residential properties. Furthermore, being a first-time business owner and operator presented a significant risk factor that traditional banks were hesitant to underwrite.

The solution required expert financial structuring. By assessing the client’s total borrowing position, an advisor was able to un-cross the existing property loans and leverage the significant equity in the client’s residential portfolio. The new commercial loan for the café acquisition was then secured against both the home and the investment property, resulting in a low overall Loan-to-Value Ratio (LVR) of under 50%. This strategy not only mitigated the perceived risk for the commercial lender but, critically, optimized the client’s entire portfolio. The restructuring secured the lowest commercial rate available in the market, a rate that was, remarkably, lower than the residential rates the client had previously been paying. This case illustrates that major business purchases often require complex structural solutions that combine commercial lending expertise with residential mortgage knowledge.

Case Study B: Retail Expansion and Short-Term Inventory Bridge

For the retail sector, particularly those involved in fast-moving consumer goods (FMCG) like the modern tea business Blak Brews, the critical variable is speed and flexibility. This business, which started with market stalls, needed to scale rapidly after finding success, expanding its distribution into high-end venues and launching its own flagship venue. This rapid growth required quick capital injections for inventory, fit-out costs, and operational scaling.

In such growth phases, delays in funding can cause businesses to miss supply chain opportunities or crucial seasonal windows. The proprietors evaluated their options, concluding that small business loans were preferable to investor funding (retaining full ownership and control) and superior to invoice factoring (which sacrifices a large portion of earnings). This scenario is perfectly suited for non-bank instruments, such as unsecured business loans or lines of credit, which are designed to be fast and flexible, often providing access to funding within 24 hours or less. The key takeaway is that for businesses undergoing rapid expansion, capital velocity is often more valuable than marginal interest rate savings.

Case Study C: Urgent Cash Flow Management in Hospitality

The hospitality industry is inherently sensitive to cash flow fluctuations, driven by seasonality, unexpected equipment failures, or delayed receivables. When café owners faced an urgent need for funds to manage immediate operational shortfalls, they found that traditional bank loans “took too long, and they needed money now”.

This common difficulty highlights the gap in the market that non-bank and specialised short-term lenders fill. These providers leverage emerging technologies and transaction data to rapidly assess creditworthiness, making unsecured credit available extremely quickly. This ability to disburse funds within a matter of hours provides a vital resource for crisis mitigation or capitalizing on time-sensitive opportunities, enabling businesses to pay employees and bills on time even when client payments are delayed.

Decoding the Lending Market: Banks vs. Non-Bank Innovators

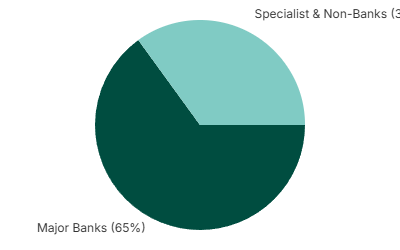

Australian Business Lending Market Share (SME Focus)

Non-bank lenders are rapidly gaining market share due to speed and flexibility.

The Australian SME lending market is bifurcated, composed of established traditional banks and an accelerating segment of non-bank and fintech lenders. Understanding the characteristics, strengths, and weaknesses of each channel is paramount for the strategic borrower.

3.1 Traditional Banking: Strengths and Structural Rigidities

Major banks offer security and familiarity, providing a range of products designed for various SME needs.

- Secured and Growth Finance: Products such as the NAB Business Options Loan or the CommBank BetterBusiness Loan are suitable for medium-to-long-term growth, large investments, or commercial property purchases. These loans generally require substantial documentation and often rely on collateral security.

- Rapid Unsecured Products: Banks have attempted to compete with the speed of fintechs. The NAB QuickBiz Loan, for instance, offers an unsecured loan range of $5,000 to $250,000 with a fixed interest rate. The bank advertises that funds may be accessed within one business day once approval is granted.

- Specialist Merchant Finance: NAB has also introduced products like the Flex-Flow Loan, a merchant finance solution designed exclusively for existing NAB merchants. This loan features 0.00% p.a. interest but includes a one-time upfront fee. Repayments automatically flex daily, calculated as an agreed percentage (10% to 30%) of daily merchant sales, mimicking the flexibility of alternative lenders.

Despite these offerings, traditional banks struggle with structural rigidities. Their primary limitation is their product universe, which is restricted entirely to the bank’s proprietary suite. Furthermore, the application process is often slow. In complex or non-standard cases, applications frequently “fall through the cracks and stall” due to the necessity of involving multiple internal departments and strict, inflexible policies. The promise of one-day funding, such as that offered by the QuickBiz loan, is contingent on the application receiving unconditional approval without manual review or any requirement for additional information. For the typical proprietor dealing with complex financials or unique circumstances, the advertised speed often proves elusive.

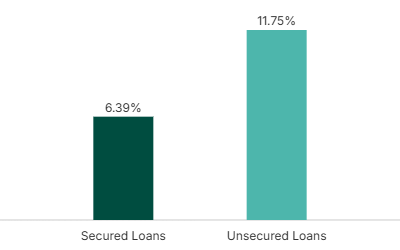

Average Starting Rates & Security

Rates are indicative starting rates and are subject to change and lender assessment.

3.2 The Rise of the Non-Bank Lender: Speed and Specialization

The non-bank sector is rapidly transforming the SME funding landscape, actively filling the gap created by systemic bank disengagement from small business risk. Data shows a structural shift: a record 52% of Australian SMEs now plan to use non-bank lending to fund new business investment, surpassing the 42% planning to use traditional banks.

Non-bank lenders specialize in agility and product diversity, offering solutions tailored to specific needs that banks often overlook:

- Working Capital: Invoice financing unlocks capital tied up in unpaid receivables, offering a critical solution for managing fluctuating cash flow.

- Asset Finance: Providing dedicated finance for vehicles, machinery, and specialized equipment.

- Short-Term Funding: Offering business overdrafts and bridging loans to manage seasonal demand or immediate project costs.

Non-bank lenders accept greater risk profiles, which means their average lending rates are higher than bank rates, resulting in a larger spread compared to traditional bank lending. For instance, unsecured loans from alternative lenders can start from 11.75% p.a., with some platforms quoting estimated rates between 9% and 24% p.a. inclusive of fees. However, this higher cost is strategically offset by unparalleled speed and minimal security requirements. Many fintech platforms offer unsecured loans up to $200,000 , with approval decisions rendered within an hour and funds disbursed in as little as three hours to 24 hours.

This trade-off between price and speed must be evaluated strategically. When a business faces a critical, time-sensitive opportunity or a severe cash-flow event, the financial cost of missing that window due to slow bank processing can far outweigh the cost of a higher, short-term interest rate from a non-bank specialist. Non-bank lending enables businesses to respond to market dynamics with the velocity necessary to maintain a competitive edge.

3.3 Key Comparison Metrics: Speed, Cost, and Flexibility

The decisive factor in modern SME finance is speed to funding, particularly for growth investments or urgent working capital requirements.

Table 2: Comparison of Application and Funding Speed (Banks vs. Non-Banks)

| Lending Channel/Product Type | Application Time | Approval Time | Funding Time (After Approval) |

| Traditional Bank (Standard Commercial) | Varies, high paperwork | Weeks (complex cases) | Days to Weeks |

| Major Bank (Fintech-Mimic e.g., NAB QuickBiz) | 15–20 minutes online | Instant Decision possible | Within 1 Business Day (if unconditional) |

| Non-Bank/Fintech (e.g., Prospa, Max Funding) | 10 minutes online | Within 1 hour (same day) | From 3 hours to 24 hours |

| Broker-Assisted Application | Streamlined/Expert pre-qualification | Accelerated due to preparation | Minimised delays across all channels |

This data confirms that the broker-assisted channel, leveraging the efficiency of non-bank providers, offers the fastest pathway to securing essential capital.

The Strategic Advantage of the Licensed Mortgage Broker

| Feature | Major Bank (Direct) | Licensed Mortgage Broker |

| Product Range | Limited to their own products and internal policies. | Access to hundreds of products across major banks and non-bank specialist lenders. |

| Speed of Approval | Often a lengthy, documentation-heavy process. | Faster turnaround, leveraging established lender relationships and streamlined application. |

| Client Focus | Primarily focused on mitigating the bank’s risk. | Legally required to act in your best interests (Best Interests Duty). |

| Complex Scenarios | Strict criteria; may reject applications with irregular cash flow or low credit scores. | Expertise in finding solutions for complex cases (e.g., self-employed, newer businesses). |

| Cost | May offer the lowest advertised rate, but only for the most prime applicants. | Saves you time and often secures a competitive rate you wouldn’t find alone, typically paid by the lender. |

The decision to use a licensed mortgage broker, especially for complex commercial finance, represents a strategic choice for efficiency, market access, and fiduciary protection. While some proprietors believe that approaching a bank directly will save money by avoiding an intermediary , the evidence overwhelmingly suggests the opposite: a broker can secure a superior financial structure that saves tens of thousands of dollars over the life of the loan.

4.1 The Best Interests Duty (BID) Mandate: Protecting the Client

A critical differentiator for licensed brokers is their legal and professional obligation under the Australian Securities and Investments Commission (ASIC) framework. Licensed mortgage brokers are governed by the National Consumer Credit Protection Act 2009 (National Credit Act) and must adhere to the stringent Best Interests Duty (BID).

The BID mandates a comprehensive three-step process to ensure client protection:

- Gathering Information: Investigating the client’s full circumstances, objectives, and financial situation.

- Making an Individual Assessment: Considering a range of relevant products available across the market to meet the client’s specific goals.

- Recommendation: Assessing and suggesting the option(s) that are in the client’s best interests.

This regulatory framework establishes a fundamental difference between brokers and bank personnel. Bank staff are primarily employed to sell the bank’s proprietary products. In contrast, a licensed broker sells a

service—they function as a researcher, pre-qualifier, and strategic assistant, acting as a true intermediary for the client.

Furthermore, brokers operate under continuous professional scrutiny. They must hold the necessary qualifications (Certificate IV/Diploma) and carry mandatory Professional Indemnity (PI) insurance, typically with a minimum of $2 million per claim. This commitment to continuous professional standards and mandatory compliance ensures accountability and provides a necessary layer of protection for the SME owner navigating the complex commercial credit market.

4.2 Access to Comprehensive Choice and Tailored Solutions

The single greatest advantage a broker offers is choice. When a proprietor engages a commercial broker, they gain immediate access to a lending panel that typically includes 20 to 30 or more lenders and thousands of products, compared to the single product suite offered by a high-street bank. This collective panel often represents around 90% of all loans organised in Australia.

This breadth of access enables the broker to deliver truly tailored solutions. They can identify niche lenders specializing in equipment finance for the construction sector, or non-bank financiers who are amenable to unsecured lending for high-growth tech firms. A broker’s deep market knowledge allows them to navigate the nuances of lender appetites, which is crucial for maximizing the client’s borrowing power. By correctly presenting the business’s profile and future goals, the broker significantly enhances the likelihood of approval and ensures the financial product precisely matches the business’s strategic requirements.

4.3 Simplifying Complexity and Maximizing Capacity

Commercial financing is significantly more complex than residential lending. The capacity of a broker to streamline the process saves the proprietor significant time and money. Instead of dedicating valuable operational hours to researching lenders, gathering rate information, and establishing new banking relationships, the client relies on the broker’s existing contacts and expertise.

Crucially, brokers guide clients through the entire application process, offering expert advice on the necessary documentation (such as BAS statements, profit and loss reports, and financial forecasts) required to support the application. This meticulous pre-qualification minimizes the risk of applications stalling or being rejected due to incomplete or misaligned information.

Brokers excel particularly in handling unique or complex financial situations—scenarios where banks become rigid and difficult to negotiate with. This includes securing finance for younger firms, managing complex ownership structures, or optimizing existing financial portfolios, such as the strategic un-crossing of cross-collateralized loans demonstrated in the earlier café acquisition case study. For the proprietor, the broker acts as a professional guide, ensuring that complex financial structuring is executed with efficiency and precision. Furthermore, the relationship is long-term, offering continuous support for refinancing and advising on future financial needs as the business evolves.

4.4 Financial Efficiency Analysis

The overall efficacy of the broker channel compared to self-sourcing through a single bank is best demonstrated by synthesizing the core advantages in market access, fiduciary duty, and overall process efficiency.

Table 3: Channel Comparison: Banks vs. Licensed Mortgage Brokers for SME Funding

| Feature | Traditional Bank (Self-Sourced) | Licensed Mortgage Broker (Channel Access) |

| Product Universe | Limited to one bank’s proprietary products | Access to 20–30+ Lenders (Banks & Non-Banks) |

| Focus/Duty | Sales of bank products/solutions | Client advocacy under ASIC Best Interests Duty (BID) |

| Flexibility for Complexity | Rigid policies; difficult for non-standard or young firms | High flexibility; can handle complex structures like cross-collateralization |

| Speed/Efficiency | Slow for documentation and assessment; prone to stalling | Highly efficient; quick pre-qualification and submission; minimises funding delays |

| Cost Saving Potential | Dependent on the single bank’s offering | Can secure the lowest commercial rate available across the market |

| Ongoing Support | Transactional; ends upon loan settlement | Ongoing relationship support for refinancing and changing needs |

Summary and Your Next Step Towards Quick Funding

5.1 Investment Certainty in Uncertain Times

The Australian local business community faces persistent economic complexities, characterized by elevated input costs and tighter operating margins, making the efficient sourcing of capital more critical than ever. The data confirms that debt finance is the preferred engine for SME growth, supporting vital functions such as innovation, equipment upgrades, and market expansion.

The lending market presents two distinct pathways: traditional banks offer perceived stability but impose high-risk margins and often suffer from structural rigidities that delay funding for all but the simplest cases. Conversely, the non-bank sector offers incredible speed and specialized products tailored for cash flow and rapid expansion, representing a structural shift that over half of Australian SMEs now plan to leverage.

For the growth-oriented proprietor, the challenge is not merely finding a loan, but identifying the optimal financial structure that balances speed, cost, and risk mitigation. This requires bridging the gap between the speed of the non-bank sector and the competitive rates sometimes available in the highly structured bank market. This delicate balance, particularly concerning collateralisation, regulatory compliance, and total cost of credit, necessitates expert assistance.

The conclusion drawn from this comprehensive analysis is that navigating this fragmented landscape effectively requires a dedicated professional partner. A Licensed Mortgage Broker, operating under the ASIC Best Interests Duty, provides the necessary strategic oversight, market access, and fiduciary protection to ensure the financial solution secured is truly aligned with the business’s long-term success.

5.2 Introduction: Your Dedicated Funding Expert

Accessing the right funding quickly is often the difference between stagnation and seizing a critical business opportunity.

Kerry-Anne is a Licensed Mortgage Broker who specializes in connecting Australian businesses with the capital they need with maximum efficiency and speed.

As an expert intermediary, Kerry-Anne’s service directly addresses the common challenges faced by proprietors:

- Rapid Access to the Full Market: Kerry-Anne provides immediate access to the entire funding universe, encompassing all major banks, boutique commercial lenders, and high-speed non-bank fintech platforms. This extensive network guarantees the fastest route to finance, whether the requirement is a short-term, unsecured injection in hours, or a complex, long-term commercial property structure.

- Fiduciary Protection: Operating under the stringent ASIC Best Interests Duty, Kerry-Anne is legally obliged to act in your financial interest, ensuring the loan terms and total cost of credit are optimized for your business, saving you money over the life of the loan.

- Complexity Management: Kerry-Anne specializes in streamlining documentation, pre-qualifying complex business scenarios, and managing the required collateral structuring, cutting through bureaucratic delays that often stall self-sourced bank applications.

If your local business requires strategic funding to capitalize on a time-sensitive opportunity, manage cash flow, or fund expansion, Kerry-Anne provides the expertise and efficiency required to ensure you gain quick funding in Australia.