Here’s a comprehensive Credit Score Improvement Guide

Here’s a comprehensive Credit Score Improvement Guide to help you understand how to boost your credit score over time:

Credit Score Improvement Guide

A good credit score can open doors to better loans, lower interest rates, and even easier approval for renting apartments. Improving your credit score takes time, but it’s worth the effort. Here’s a step-by-step guide to help you get there:

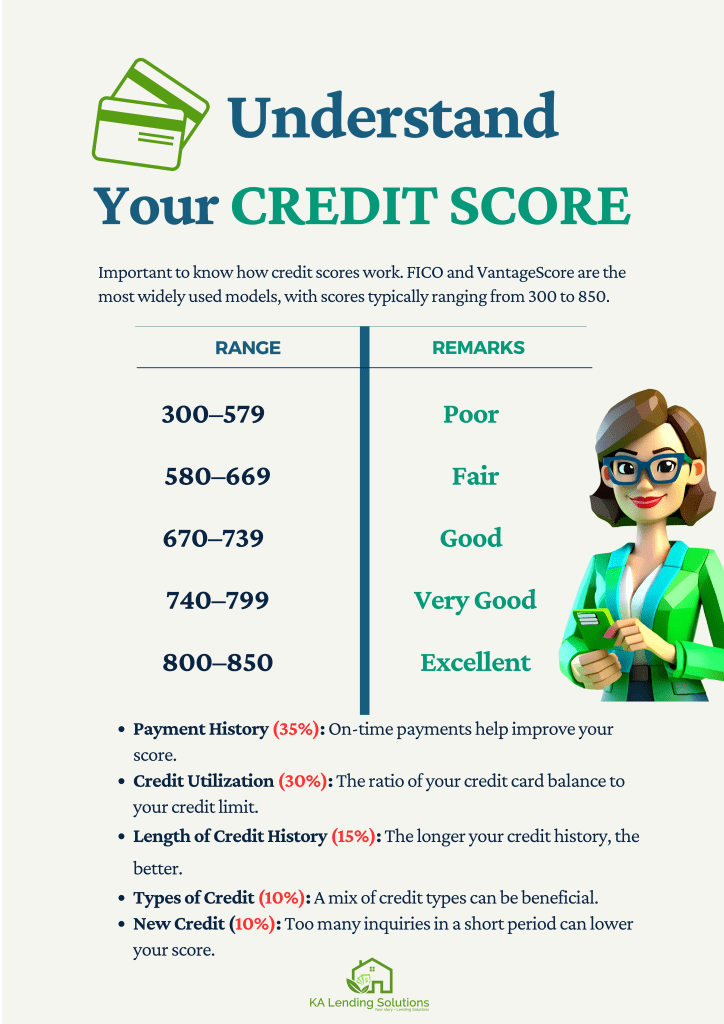

1. Understand Your Credit Score

First, it’s important to know how credit scores work. FICO and VantageScore are the most widely used models, with scores typically ranging from 300 to 850.

- 300–579: Poor

- 580–669: Fair

- 670–739: Good

- 740–799: Very Good

- 800–850: Excellent

Factors that impact your credit score:

- Payment History (35%): On-time payments help improve your score.

- Credit Utilization (30%): The ratio of your credit card balance to your credit limit.

- Length of Credit History (15%): The longer your credit history, the better.

- Types of Credit (10%): A mix of credit types can be beneficial.

- New Credit (10%): Too many inquiries in a short period can lower your score.

2. Check Your Credit Reports

- Get Your Free Report: Request your credit reports annually from the three major credit bureaus: Equifax, Experian. AnnualCreditReport.com.

- Review for Errors: Check for any inaccuracies, such as wrong account details, late payments marked incorrectly, or accounts that don’t belong to you.

- Dispute Errors: If you find mistakes, dispute them with the credit bureaus to have them corrected.

3. Pay Your Bills on Time

Your payment history has the largest impact on your score.

- Set Up Payment Reminders: Use calendar alerts or automatic payments to avoid missing deadlines.

- Catch Up on Late Payments: If you have any overdue payments, make an effort to pay them as soon as possible. The longer you wait, the more it negatively impacts your score.

4. Lower Your Credit Utilization

Credit utilization is the ratio of your credit card balances to their credit limits.

- Keep It Below 30%: Aim to use no more than 30% of your available credit. If possible, try to keep your utilization below 10% for the best results.

- Pay Down Balances: Paying off high balances will improve your utilization ratio and thus boost your score.

- Request Higher Credit Limits: If you’re unable to pay down your balances quickly, consider asking your card issuers for a credit limit increase (without increasing your spending).

5. Avoid Opening New Credit Accounts

Each time you apply for a new credit account, a hard inquiry is made, which can temporarily lower your score.

- Limit New Applications: Don’t open too many new accounts in a short period. Only apply when absolutely necessary.

- Keep Old Accounts Open: The length of your credit history matters. Avoid closing old accounts, as doing so shortens your average account age, which can hurt your score.

6. Deal with Existing Debt

If you have multiple debts, consolidating them or creating a repayment plan may help.

- Debt Consolidation: Consider consolidating your credit card debt into one loan with a lower interest rate.

- Pay More Than the Minimum: Try to pay off more than the minimum payment on your credit cards to reduce your debt faster.

- Consider Debt Settlement or Credit Counseling: If you’re overwhelmed by debt, a debt settlement program or credit counseling service can help you manage your debt more effectively.

7. Diversify Your Credit Types

Having a mix of credit types (e.g., credit cards, personal loans, car loans) can improve your score. However, don’t open new accounts just to improve your score. Only open new credit lines when necessary.

8. Consider Becoming an Authorized User

Ask a family member or friend with good credit if you can be added as an authorized user on their credit card account.

- Benefit from Their Good History: You’ll benefit from their on-time payments and low credit utilization, which can help increase your score.

- No Liability: You won’t be responsible for the payments, but their good credit behavior will impact your score.

9. Be Patient and Consistent

Improving your credit score is a long-term process, especially if your credit history includes negative marks. Keep the following in mind:

- Stay Consistent: Consistent, positive behavior (paying bills on time, keeping debt low) will eventually result in a higher score.

- It Takes Time: Negative marks like late payments, bankruptcies, and high debt take years to fall off your report, but the positive effects of improving your habits will start to show after a few months.

10. Seek Professional Help If Needed

If your credit is seriously damaged or you’re struggling with overwhelming debt, consider seeking help from a certified credit counselor or financial advisor. They can assist you in developing a plan to improve your financial situation.

Quick Tips for Boosting Your Credit Score:

- Set up automatic payments to avoid late payments.

- Try debt snowball or debt avalanche methods to pay off high-interest debt faster.

- Don’t open multiple credit accounts at once.

- Negotiate with creditors for lower interest rates or settlements.

- Always review your credit reports for inaccuracies.

- Be cautious of too many hard inquiries within a short period.

Wrapping it Up…

Improving your credit score is a gradual process, but with consistency and the right strategies, you can increase your score over time. By following the steps above and remaining disciplined, you’ll be on your way to enjoying the benefits of a strong credit profile.