Process of Buying an Investment Property Using Your SMSF

Process of Buying an Investment Property Using Your SMSF

Buying an investment property through a Self-Managed Super Fund (SMSF) is a powerful way to build wealth for retirement, but it involves strict rules and compliance requirements. Below is a step-by-step guide to ensure a smooth process:

Step 1: Ensure Your SMSF is Set Up Correctly

Before purchasing property, your SMSF must be properly established and comply with Australian Taxation Office (ATO) and Superannuation Industry (Supervision) Act 1993 (SIS Act) regulations.

✅ Have an SMSF Trust Deed – This outlines the fund’s rules.

✅ Register the SMSF with the ATO – Obtain an ABN and TFN.

✅ Open a Separate SMSF Bank Account – To manage super contributions and transactions.

✅ Create an Investment Strategy – It must justify property as a viable investment option.

Step 2: Understand SMSF Property Rules

📌 The property must be for investment purposes only – You cannot live in it or rent it to family members.

📌 The property must comply with the sole purpose test – It should solely provide retirement benefits to SMSF members.

📌 If using an SMSF loan, you must purchase under a Limited Recourse Borrowing Arrangement (LRBA).

Step 3: Determine How You Will Fund the Property Purchase

You can purchase property through SMSF using:

💰 Cash Purchase – If the SMSF has enough funds.

🏦 Limited Recourse Borrowing Arrangement (LRBA) – A specialized loan that restricts the lender’s claim to only the property, protecting other SMSF assets.

💲 Super Contributions & Rollovers – Members can contribute to the SMSF to build purchasing power.

Step 4: Find a Suitable Investment Property

🔍 Ensure the property aligns with your investment strategy and meets the SMSF borrowing rules.

🔍 Research rental yield, capital growth, and location.

🔍 Work with an SMSF property specialist or buyer’s agent to find compliant options.

Step 5: Obtain SMSF Loan Pre-Approval (If Borrowing)

If an LRBA loan is required, you need to:

✅ Work with an SMSF loan specialist or mortgage broker.

✅ Apply for a pre-approved SMSF loan before making an offer.

✅ Ensure the SMSF has enough funds for the deposit, stamp duty, and legal fees.

Step 6: Set Up a Bare Trust for Property Ownership

📌 A Bare Trust (Holding Trust) must be established – This legally holds the property on behalf of the SMSF while the loan is active.

📌 The SMSF is the beneficial owner, but the trust is the legal owner until the loan is repaid.

Step 7: Make an Offer and Finalize the Purchase

✍ Sign a contract of sale in the name of the Bare Trust (not the SMSF directly).

💰 Pay the deposit from the SMSF’s bank account.

🏦 Obtain formal loan approval and satisfy lender requirements.

📜 Engage a solicitor to handle legal requirements, including stamp duty and compliance checks.

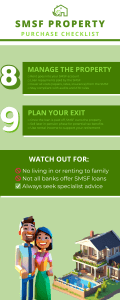

Step 8: Manage the Investment Property

Once settled, the property becomes an SMSF asset.

🏡 Rental income must be paid into the SMSF account.

💸 Loan repayments must be made from the SMSF.

📊 Ongoing costs (repairs, insurance, council rates) must be paid by the SMSF.

📑 Annual SMSF audit and compliance reporting is required.

Step 9: Plan for Exit Strategy & Retirement Benefits

🛑 When the loan is repaid, the SMSF gains full ownership of the property.

📈 The property can be sold tax-effectively in retirement if held until the pension phase (potential zero capital gains tax).

💰 Rental income can be used as retirement income for SMSF members.

Things to Watch Out For

🚫 You cannot live in or use the property for personal purposes.

🚫 Not all lenders offer SMSF loans – Work with a specialist SMSF mortgage broker.

🚫 SMSF property investments can be complex – Get professional financial and legal advice.

Would you like assistance in finding an SMSF loan provider or property investment strategist?

List of lenders that do SMSF LOANS

Self-Managed Super Fund (SMSF) loans allow SMSFs to borrow funds for property investments.

While many major banks have reduced their offerings in this space, several non-bank and specialist lenders continue to provide SMSF loan products.

Here are some lenders that offer SMSF loans:

Please keep in mind that we have a much more extensive list and not all lenders are listed here, we have also Weatlh, BMM and much more,,,

Liberty Financial

Offers SMSF home loan solutions and SMSF commercial property loans, with options for both residential and commercial property investments. Liberty

Bank of Queensland (BOQ)

Provides SMSF loans for purchasing residential and non-specialized commercial properties for investment purposes. BOQ Personal Banking

Granite Home Loans

Specializes in SMSF lending with competitive rates and full-feature loans for those looking to invest in high-quality properties through their SMSF. Liberty+2Granite Home Loans+2BlueRock+2

Pepper Money

Offers SMSF lending solutions for both residential and commercial property investments, with flexible loan terms and features. Liberty

Firstmac

Provides SMSF loan options with competitive interest rates and flexible loan features. Savings.com.au

Please note that SMSF loans can be complex and are subject to specific regulatory requirements. It’s essential to consult with a financial advisor or mortgage broker experienced in SMSF lending to ensure compliance and suitability for your financial goals.

Setting Up the SMSF FUND

Setting up a Self-Managed Super Fund (SMSF) in Australia involves several steps and requires professional guidance to ensure compliance with regulations set by the Australian Taxation Office (ATO) and Australian Securities and Investments Commission (ASIC).

Here’s where and who can help you set up an SMSF:

1. SMSF Specialists & Professionals

You will need assistance from licensed professionals to establish and manage your SMSF correctly. The key experts include:

-

- SMSF Administrators – Handle paperwork, compliance, and ongoing management.

-

- Financial Planners – Provide investment strategy advice.

-

- Accountants & Tax Agents – Ensure compliance with tax laws and reporting obligations.

-

- SMSF Auditors – Required to conduct an annual audit of your fund.

-

- Lawyers – Draft the SMSF trust deed and ensure legal compliance.

2. Where to Set Up an SMSF

-

- Banks & Financial Institutions – Many offer SMSF setup services and investment options.

-

- SMSF Administration Companies – Specialize in setting up and managing SMSFs. Some well-known SMSF administrators in Australia include:

-

- Heffron SMSF Solutions

-

- SuperConcepts

-

- ESUPERFUND

-

- AMP SMSF Solutions

-

- SMSF Administration Companies – Specialize in setting up and managing SMSFs. Some well-known SMSF administrators in Australia include:

-

- Independent Financial Advisers – Provide tailored advice for setting up and running an SMSF.

-

- Self-Directed Online Platforms – Some online services allow you to set up an SMSF with guided support.

3. Key Steps to Set Up an SMSF

-

- Decide on Members – Maximum of 6 members (usually family or business partners).

-

- Create an SMSF Trust & Trust Deed – Legal document outlining fund rules.

-

- Register the SMSF with the ATO – Obtain an ABN & TFN.

-

- Open a Bank Account – To manage contributions and investments.

-

- Develop an Investment Strategy – Compliant with SIS Act regulations.

-

- Roll Over Superannuation Funds – Transfer existing super funds into the SMSF.

-

- Start Investing – Within legal and regulatory guidelines.

-

- Annual Reporting & Auditing – Lodge tax returns and have an independent audit.

Helpful Government Links

-

- ATO Guide on SMSFs: ATO SMSF Information

-

- ASIC’s Moneysmart SMSF Guide: Moneysmart SMSF

Would you like recommendations for specific SMSF providers based on your needs?